Investing in real estate can be one of the most lucrative decisions you make, provided you have the right tools and knowledge to analyze properties effectively. Whether you’re a seasoned investor or just starting, understanding the key financial metrics to evaluate investment properties is crucial. These metrics not only offer a glimpse into the potential profitability and risk associated with a property but also empower you to make informed decisions that align with your investment goals.

The essence of real estate investment analysis lies in deciphering the numbers to unlock the true value of a property. This goes beyond the surface details of location and property condition, delving deep into the financial performance and potential return on investment (ROI) that a property can offer. With a myriad of factors influencing the success of a real estate investment, it’s the precise, calculated analysis using these metrics that separates successful investors from the rest.

This article is designed to guide you through the most critical financial figures used in the real estate industry. From the Capitalization Rate (Cap Rate) to Cash on Cash Return, Gross Rental Yield, Net Operating Income (NOI), and Debt Service Coverage Ratio (DSCR), we’ll explore how each metric is calculated and applied in investment property analysis. These metrics serve as the foundation for evaluating the profitability, risk, and financial health of real estate investments.

By the end of this guide, you’ll have a comprehensive understanding of the key metrics that seasoned investors rely on to assess and compare investment opportunities. Armed with this knowledge, you’ll be better positioned to identify properties that align with your investment strategy, manage risks effectively, and ultimately, unlock the true value of your real estate investments. Let’s dive into the numbers and explore the financial metrics that are essential for every real estate investor to know.

Capitalization Rate (Cap Rate): A Core Metric for Real Estate Investment Analysis

The Capitalization Rate, commonly referred to as Cap Rate, is a fundamental metric used by real estate investors to evaluate the potential return on an investment property. Understanding Cap Rate is essential for comparing the profitability of different real estate investments, making it a critical figure in the investor’s toolkit.

What is Cap Rate?

Cap Rate measures the expected return on an investment property without factoring in financing. It’s calculated by dividing the Net Operating Income (NOI) of a property by its current market value. Essentially, it provides an estimate of the investor’s yield on a property if purchased in cash, offering a quick way to compare the profitability of various properties.

Calculating Cap Rate

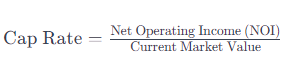

The formula for calculating Cap Rate is:

- Net Operating Income (NOI): This is the annual income generated by the property after all operating expenses have been deducted, but before deducting any payments for loans or taxes.

- Current Market Value: The current purchase price or value of the property.

Significance of Cap Rate in Real Estate Investment

- Comparative Tool: Cap Rate is a powerful tool for comparing the potential return of different properties, regardless of their size or type. A higher Cap Rate typically indicates a potentially higher return on investment, albeit with potentially higher risk.

- Investment Decision Making: By calculating the Cap Rate, investors can quickly gauge whether a property meets their return on investment criteria and decide accordingly.

- Market Trends: Changes in Cap Rates over time can signal shifts in the real estate market, helping investors to identify trends and adjust their strategies.

Example

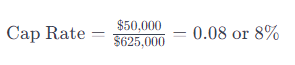

Consider a property with an NOI of $50,000 and a current market value of $625,000. The Cap Rate would be calculated as follows:

This means the property is expected to yield an 8% return on investment annually, assuming it’s bought in cash.

Limitations of Cap Rate

While Cap Rate is a valuable metric, it’s not without its limitations. It does not take into account mortgage payments or future increases in operating costs, nor does it consider the potential for property value appreciation or depreciation. Therefore, it should be used in conjunction with other financial metrics for a comprehensive analysis.

The Capitalization Rate is a critical metric for real estate investors, providing a quick and effective way to assess the potential return on investment properties. By mastering Cap Rate calculations, investors can make more informed decisions, comparing properties efficiently and identifying those that best meet their investment goals. However, successful real estate investment analysis requires considering multiple metrics to get a full picture of an investment’s potential.

Cash on Cash Return: Understanding Your Investment’s Performance

Cash on Cash Return is a crucial metric for real estate investors, particularly because it takes into account the financing used to purchase the property. This metric provides a clear picture of the investment’s yield based on the actual cash invested, making it an invaluable tool for evaluating the financial performance of leveraged properties.

What is Cash on Cash Return?

Cash on Cash Return calculates the annual return the investor made on the property in relation to the amount of mortgage paid during the same year. It is expressed as a percentage and gives investors a more accurate understanding of their investment’s performance by considering the effect of leverage.

Calculating Cash on Cash Return

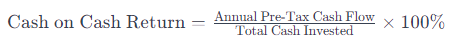

The formula for Cash on Cash Return is:

- Annual Pre-Tax Cash Flow: This is the net income from the property, after operating expenses and mortgage payments, but before taxes.

- Total Cash Invested: The total amount of cash invested in the property, including down payment, closing costs, and any rehab expenses paid in cash.

Importance of Cash on Cash Return

- Impact of Financing: Unlike Cap Rate, Cash on Cash Return shows the impact of financing on an investment’s yield, providing a clearer picture for investors using mortgages.

- Investment Strategy Alignment: It helps investors understand whether a property’s performance aligns with their investment strategy, especially when considering cash flow objectives.

- Comparative Analysis: Investors can compare the Cash on Cash Returns of different properties, factoring in their unique financing structures, to identify the best investment opportunities.

Example

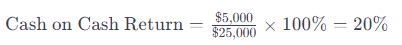

Suppose you purchase a property for $100,000, with a down payment of $20,000 and additional closing costs of $5,000. If the annual pre-tax cash flow from the property is $5,000, the Cash on Cash Return would be calculated as follows:

This result indicates a 20% annual return on the actual cash invested in the property.

Cash on Cash Return is a vital metric for evaluating the performance of real estate investments, especially for those utilizing leverage. By understanding and applying this metric, investors can make more informed decisions, ensuring their investments align with their financial goals and cash flow expectations.

Gross Rental Yield: Measuring Income Potential

Gross Rental Yield is a crucial metric for real estate investors aiming to gauge the income potential of their properties relative to their purchase price. This figure offers a straightforward way to compare the annual rental income a property can generate against its cost, providing insights into the property’s profitability before operating expenses are factored in.

What is Gross Rental Yield?

Gross Rental Yield is calculated by taking the annual rental income a property generates and dividing it by the property’s purchase price (or current market value), then multiplying by 100 to get a percentage. This metric helps investors quickly assess the income efficiency of different investment properties.

Calculating Gross Rental Yield

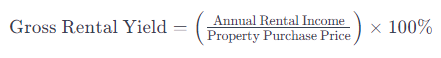

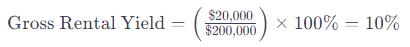

The formula for Gross Rental Yield is:

- Annual Rental Income: The total rent collected from the property over a year.

- Property Purchase Price: The total cost of acquiring the property, including the purchase price and any additional expenses required to make the property rentable.

Importance of Gross Rental Yield

- Comparative Analysis: Gross Rental Yield allows investors to compare the income potential of various properties, aiding in identifying those that offer higher returns on investment.

- Investment Strategy: It helps investors align property selections with their investment goals, whether they’re seeking high-yield properties or those with potential for capital appreciation.

- Market Evaluation: Analyzing rental yields across different regions can highlight market trends, guiding investors towards areas with higher rental demand and income potential.

Example

If a property is purchased for $200,000 and generates an annual rental income of $20,000, the Gross Rental Yield would be calculated as follows:

This indicates that the property’s annual income is 10% of its purchase price, offering a quick snapshot of its income-generating efficiency.

Gross Rental Yield is an indispensable metric for investors looking to understand the income-generating capacity of their real estate investments. By calculating and comparing gross rental yields, investors can make more informed decisions, selecting properties that offer the best potential for rental income relative to their cost.

Net Operating Income (NOI): The Heartbeat of Property Performance

Net Operating Income, or NOI, is a fundamental metric that measures the profitability of an investment property, excluding the costs of financing and taxes. It provides investors with a clear picture of how a property’s operational aspects contribute to its overall financial health.

What is NOI?

NOI represents the total income a property generates from its operations, minus the necessary operating expenses. It excludes loan payments, capital expenditures, depreciation, and taxes to focus purely on the property’s operational efficiency.

Calculating NOI

The formula to calculate NOI is straightforward:

NOI = Gross Rental Income − Operating Expenses

- Gross Rental Income: This includes all income from rents and any other property-related income, like parking fees and service charges.

- Operating Expenses: These are the costs associated with running and maintaining the property, such as property management fees, maintenance costs, utilities (if paid by the owner), insurance, and property taxes.

Importance of NOI

- Investment Valuation: NOI is crucial for determining the value of income-generating properties through the Cap Rate formula.

- Loan Securing: Lenders often look at a property’s NOI to assess its ability to cover mortgage payments, influencing loan approval decisions.

- Performance Tracking: NOI helps investors track the financial performance of their properties over time, identifying opportunities for improvement.

Example

If a property generates $120,000 in annual rental income and incurs $40,000 in operating expenses, the NOI would be:

NOI = $120,000 − $40,00 = $80,000

This indicates that the property’s operations generate a net income of $80,000 annually before financing and tax considerations.

NOI is a vital indicator of a property’s operational success, offering insights into its profitability and financial stability. By understanding and analyzing NOI, real estate investors can make informed decisions about purchasing, improving, and financing properties.

Next, we’ll discuss the Debt Service Coverage Ratio (DSCR), which evaluates a property’s ability to cover its debt obligations with its income.

Debt Service Coverage Ratio (DSCR): Ensuring Financial Health

The Debt Service Coverage Ratio (DSCR) is a crucial metric used by lenders and investors to evaluate a property’s ability to generate enough income to cover its debt payments, including interest and principal repayments. It offers insights into the financial health and risk level of an investment property.

What is DSCR?

DSCR is calculated by dividing a property’s Net Operating Income (NOI) by its total debt service obligations for the same period. A DSCR greater than 1 indicates that the property generates sufficient income to cover its debt payments, while a DSCR less than 1 suggests that the property’s income falls short.

Calculating DSCR

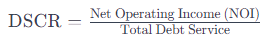

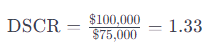

The formula for DSCR is:

- Net Operating Income (NOI): The income from the property after operating expenses are subtracted.

- Total Debt Service: The annual total of all debt payments on the property, including both principal and interest.

Importance of DSCR

- Loan Approval: Lenders typically require a DSCR of 1.2 or higher for loan approval, as it indicates the property can cover its debt payments with a margin of safety.

- Investment Analysis: For investors, a high DSCR can signal a good investment opportunity, indicating that the property is generating enough income to not only cover its debts but also provide cash flow.

- Risk Management: DSCR helps in assessing the risk associated with an investment property, with higher ratios indicating lower risk.

Example

If a property’s NOI is $100,000 and its total debt service for the year is $75,000, the DSCR would be:

This means the property generates 33% more income than needed to cover its annual debt payments, indicating good financial health.

The Debt Service Coverage Ratio is an indispensable metric for both lenders and investors, providing a clear measure of a property’s ability to handle its debt obligations. Understanding and utilizing DSCR allows for better decision-making in financing and investing, ensuring the

As we conclude our exploration of the key financial metrics used by investors to analyze investment properties, it’s evident that these figures play a crucial role in making informed investment decisions. From the Capitalization Rate (Cap Rate) to Cash on Cash Return, Gross Rental Yield, Net Operating Income (NOI), and Debt Service Coverage Ratio (DSCR), each metric offers unique insights into the profitability, risk, and financial health of real estate investments.

Empowering Investment Decisions with Key Metrics

Understanding and applying these metrics enables investors to navigate the complex landscape of real estate investment with confidence. By meticulously analyzing properties using these figures, investors can:

- Identify properties that offer the best potential for financial return.

- Assess the risk associated with different investment opportunities.

- Make comparisons across properties and markets to find the best fits for their investment goals.

- Secure financing more easily by presenting properties that meet or exceed lenders’ financial criteria.

Moreover, these metrics are not just tools for individual assessment; they are part of a broader strategy that involves market analysis, understanding economic trends, and recognizing the impact of location and property condition on investment success.

Moving Forward

As the real estate market continues to evolve, so too will the strategies and metrics used to assess investment properties. Investors who stay informed about these changes and adapt their analysis accordingly will be better positioned to capitalize on new opportunities and navigate potential challenges.

Whether you’re a seasoned investor or just starting, remember that the key to successful real estate investment lies in thorough analysis, due diligence, and a deep understanding of the financial metrics that drive property value. By leveraging these tools, you can enhance your investment portfolio’s performance and achieve your financial objectives.

We encourage investors to continue educating themselves on these metrics and to consider them as part of a holistic approach to real estate investment analysis. The more adept you become at interpreting these figures, the better equipped you’ll be to make strategic investment choices that lead to long-term success.