In the bustling rental market of Ontario, understanding the nuances of tenant insurance is crucial for both landlords and tenants. Tenant insurance, often viewed as a safety net, offers a layer of financial protection covering personal property, liability, and additional living expenses in case of unforeseen events like fire, theft, or water damage. While it’s a common assumption that a landlord’s property insurance covers all aspects of the rental property, this is a misconception. In reality, a landlord’s policy typically covers the building itself but not the personal belongings of the tenant or their personal liability.

For landlords, encouraging or requiring tenant insurance can be a strategic move. It not only protects the tenant’s belongings but also offers a buffer against potential liability claims, which might otherwise directly impact the landlord. However, the legality of mandating tenant insurance in lease agreements in Ontario is a nuanced topic, shaped by provincial laws and regulations.

This article delves into the legalities surrounding the requirement of tenant insurance in Ontario, exploring how landlords can navigate this aspect while respecting tenants’ rights and ensuring their property’s safety. We’ll examine the benefits, legal precedents, and effective communication strategies regarding tenant insurance, providing a comprehensive guide for landlords in the province.

Ontario’s Legal Stance on Tenant Insurance

In Ontario, the interplay between tenant insurance and landlord-tenant relationships has evolved, especially with the introduction of the Ontario Standardized Lease Agreement. While the Residential Tenancies Act, 2006 (RTA) sets the foundational rights and responsibilities, the standardized lease agreement has nuanced the approach towards tenant insurance.

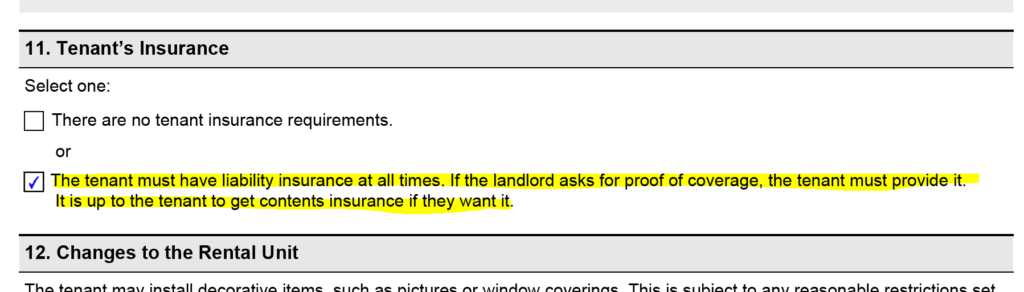

1. The RTA and Insurance Requirements: Historically, the RTA did not explicitly mandate tenant insurance. However, with the Ontario Standardized Lease, landlords have the option to include a clause requiring tenant insurance. This shift allows landlords to stipulate tenant insurance as a term of the lease, provided it is clearly outlined in the agreement.

2. The Importance of Tenant Insurance: Tenant insurance remains crucial, offering protection for personal property and liability. For landlords, a tenant’s insurance policy can provide an additional layer of protection, potentially covering costs that might otherwise impact the landlord.

3. Communicating the Benefits to Tenants: Landlords are encouraged to explain the benefits of tenant insurance to tenants. This involves not just stating the requirement but also helping tenants understand how insurance can protect their interests. Clear communication about insurance can foster a responsible tenant community.

4. Navigating Legal Boundaries: Landlords must ensure that any requirement for tenant insurance is in compliance with the terms set out in the Ontario Standardized Lease. Legal advice is advisable to ensure that lease agreements and insurance stipulations align with current laws.

5. Tenant Insurance as a Lease Requirement: With the new Ontario Standardized Lease, landlords in Ontario now have the leverage to require tenant insurance as part of the lease agreement. This change underscores the evolving nature of landlord-tenant relationships in the province, emphasizing the importance of tenant insurance in the rental market.

To conclude, Ontario landlords, under the current standardized lease terms, can require tenants to have insurance. This development highlights the significance of tenant insurance in providing financial security and peace of mind for both landlords and tenants.

Benefits of Tenant Insurance for Landlords

The inclusion of tenant insurance in lease agreements, as allowed by the Ontario Standardized Lease, brings several benefits to landlords. Understanding these advantages is key for landlords in managing their rental properties effectively.

1. Mitigating Financial Risks: Tenant insurance can mitigate financial risks for landlords. In cases where a tenant’s actions lead to property damage or injury to others on the property, the tenant’s insurance can cover these costs. This reduces the likelihood of landlords having to use their own insurance or personal funds for such incidents.

2. Enhancing Property Protection: While landlords have insurance for the property itself, tenant insurance covers the tenant’s personal belongings and any accidental damage to the property. This added layer of protection ensures that minor incidents don’t escalate into costly disputes.

3. Promoting Responsible Tenancy: Requiring tenant insurance can encourage a sense of responsibility among tenants. It makes them more aware of their actions and their potential consequences, promoting a more mindful approach to property care.

4. Streamlining Dispute Resolution: In the event of property damage or personal injury, having tenant insurance can streamline the dispute resolution process. It provides a clear pathway for compensation, potentially avoiding lengthy and complex legal disputes between landlords and tenants.

5. Building a Trustworthy Tenant Base: Landlords who require tenant insurance may attract tenants who are willing to invest in protecting their living space. This can result in a more reliable and trustworthy tenant base, reducing the turnover and vacancy rates.

In summary, requiring tenant insurance as per the Ontario Standardized Lease offers numerous benefits for landlords. It not only safeguards their property but also fosters a more responsible and secure rental environment. Landlords who understand and communicate these benefits effectively can improve their relationships with tenants and enhance their property management practices.

Communicating Tenant Insurance Requirements to Tenants

Effective communication of tenant insurance requirements is crucial for landlords, especially with the Ontario Standardized Lease allowing the inclusion of such clauses. Here’s how landlords can approach this:

1. Clear Explanation at Lease Signing: Landlords should provide a clear explanation of the tenant insurance requirement at the time of lease signing. This includes detailing what the insurance covers, why it is necessary, and how it benefits both parties. Providing informational brochures or references to insurance providers can also be helpful.

2. Incorporating Insurance Clause in Lease: The requirement for tenant insurance should be explicitly stated in the lease agreement. Landlords must ensure that the clause is compliant with Ontario’s laws and is clearly understood by the tenant. Section 11 of the Ontario Standardized Lease Agreement should be filled out.

3. Discussing Insurance Coverage Options: Landlords can guide tenants on the types of coverage available and how to choose a policy that meets their needs. While landlords should not endorse specific insurers, they can provide general advice on what to look for in a policy.

4. Addressing Tenant Concerns and Questions: Landlords should be prepared to address any concerns or questions tenants may have about the insurance requirement. This includes discussing the implications of not having insurance and how it could affect them in various scenarios.

5. Regular Reminders and Updates: Landlords may consider sending regular reminders to tenants about maintaining their insurance policies, especially upon lease renewal. Keeping tenants informed about any changes in insurance laws or best practices is also beneficial.

By communicating effectively about tenant insurance, landlords can ensure that tenants understand the importance and benefits of maintaining an insurance policy. This not only protects the landlord’s property but also fosters a more informed and responsible tenant community.

Case Studies and Legal Precedents in Ontario Regarding Tenant Insurance

To further understand the practical implications of tenant insurance requirements in Ontario, examining real-life case studies and legal precedents can be enlightening. These examples highlight how tenant insurance policies have played a role in various legal scenarios between landlords and tenants.

1. Landlord-Tenant Disputes Involving Property Damage: Cases where tenants have accidentally caused damage to rental properties illustrate the importance of tenant insurance. In several instances, courts have looked favorably upon tenants with insurance, as it provided a straightforward solution for compensating damages without lengthy legal battles.

2. Legal Precedents on Insurance Requirements: Ontario courts have adjudicated cases where the presence or absence of tenant insurance was a key factor. These rulings have helped shape the understanding of how insurance requirements can be legally incorporated into lease agreements, especially after the introduction of the Ontario Standardized Lease.

3. Insurance Disputes and Tenant Rights: There have been cases where disputes arose over the extent of coverage provided by tenant insurance policies. These cases often highlight the need for clear communication about the terms of insurance policies and underscore the importance of tenants understanding their insurance coverage.

4. Impact of Tenant Insurance on Eviction Proceedings: In some eviction cases, the presence of tenant insurance has been a mitigating factor, especially in situations involving accidental damage to the property. These cases show how tenant insurance can potentially influence the outcomes of legal proceedings.

5. Lessons Learned for Landlords and Tenants: These case studies and legal precedents serve as valuable lessons for landlords and tenants alike. They underscore the significance of tenant insurance in protecting both parties’ interests and ensuring a smoother landlord-tenant relationship.

The case studies and legal precedents in Ontario demonstrate the multifaceted role of tenant insurance in the rental market. For landlords, these examples provide insights into the practical benefits and legal considerations of requiring tenant insurance as part of the lease agreement.

The landscape of tenant-landlord relationships in Ontario has been significantly shaped by the nuances of tenant insurance, especially with the implementation of the Ontario Standardized Lease. This article has explored the legalities, benefits, communication strategies, and real-life implications of tenant insurance requirements in the rental market.

Tenant insurance, while not historically mandated by the Residential Tenancies Act, has become an important aspect in lease agreements, offering protection and peace of mind for both landlords and tenants. For landlords, it mitigates financial risks and fosters a responsible tenant base. For tenants, it provides crucial coverage for personal belongings and potential liabilities.

Effective communication about tenant insurance is key. Landlords must ensure that tenants are well-informed about their insurance obligations and understand the benefits of having such a policy. The case studies and legal precedents in Ontario demonstrate the practical implications of tenant insurance, highlighting its role in safeguarding interests and ensuring smoother resolutions in disputes.

As the rental market continues to evolve, staying informed about legal requirements and best practices in tenant insurance will remain a vital aspect of successful property management. Landlords and tenants alike should remain vigilant and knowledgeable to navigate this ever-changing landscape effectively.