Understanding property taxes is a crucial aspect of homeownership in Ottawa. As a homeowner in Canada’s capital, navigating the nuances of property tax calculations can be a complex task, especially with the recent changes and updates in the system. This article aims to demystify the process, offering a clear and comprehensive guide to how property taxes are determined in Ottawa, Ontario. From the basics of tax calculation to understanding additional charges and dealing with penalties for late payments, we will cover all the essential elements that impact your property tax bill. Whether you are a long-time homeowner or new to the property market in Ottawa, this guide will provide valuable insights to help you comprehend and efficiently manage your property tax obligations.

Understanding the Basics of Property Tax Calculation

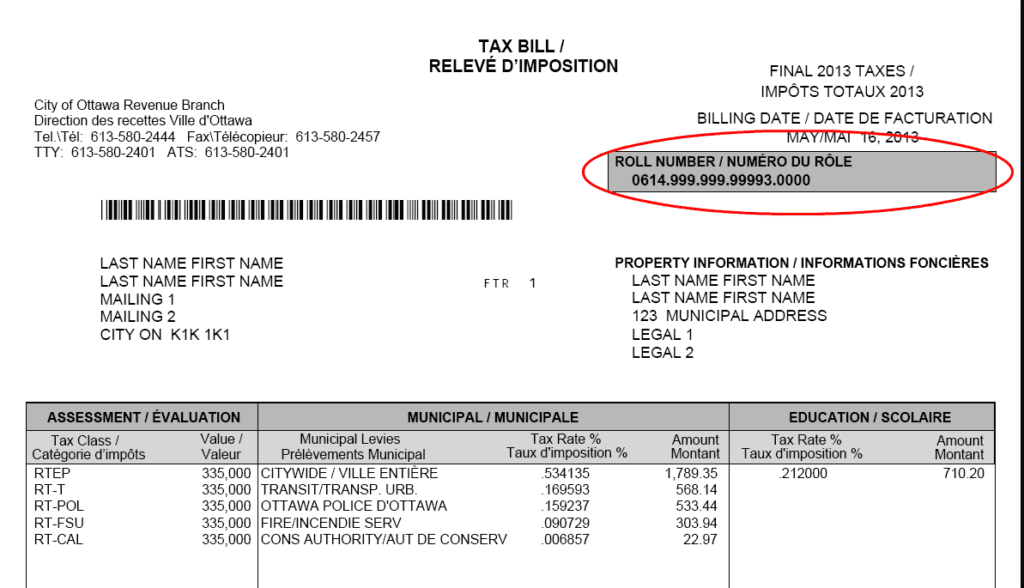

Property taxes are a significant part of homeownership in Ottawa, and understanding how they are calculated is essential for effective financial planning. The City of Ottawa calculates residential property taxes based on three primary components: the assessed value of the property, the municipal tax rate, and the education tax rate.

Assessed Property Value: The property’s assessed value is determined by the Municipal Property Assessment Corporation (MPAC), an independent body established by the Province of Ontario. This value aims to reflect the market value of the property at a given point in time.

Municipal Tax Rate: The municipal tax rate, set by the City of Ottawa, is applied to the assessed property value. This rate helps fund various city services, including public safety, road maintenance, and City recreational facilities and parks.

Education Tax Rate: In addition to the municipal tax rate, there is an education tax rate set by the Province of Ontario. This rate contributes to funding public education across the province.

The calculation of property taxes is a straightforward multiplication of the assessed property value by the sum of the municipal and education tax rates. However, the process involves several nuances, particularly regarding property value assessments and rate changes.

For instance, changes in the market, renovations, or alterations to the property can affect its assessed value. Furthermore, tax rates are subject to annual review and adjustments based on the city’s budgetary needs and provincial educational funding requirements.

Understanding these components is the first step in navigating the complexities of Ottawa’s property tax system. It’s important for homeowners to stay informed about changes in assessment values and tax rates, as these directly impact the amount of property tax due each year.

Changes in Reassessment for Commercial and Residential Properties

A key aspect of understanding property taxes in Ottawa involves being aware of the reassessment process for commercial and residential properties. Historically, property valuations in Ontario were reassessed annually. However, this approach has evolved over time.

Shift to Four-Year Phase-In Program: In recent years, the province of Ontario has replaced annual reassessments with a four-year phase-in program. This change means that property valuations are now updated less frequently, with the aim of providing more stability to taxpayers.

Impact of Postponed Reassessments: The next property valuation update was initially scheduled for 2020, covering the 2021-2024 taxation years. However, the Government of Ontario postponed this reassessment to provide continued stability. As a result, assessments for the 2022 and 2023 taxation years are based on the same valuation as in the 2020 taxation year.

Recognition of Assessment Decreases: It’s important to note that while assessment increases are phased in over the four-year period, any decreases in property value assessments are recognized immediately in the first year. This approach benefits property owners who experience a drop in their property’s market value.

This shift in the reassessment process impacts property taxes in several ways. For homeowners, it means that changes in property values are reflected more gradually in their tax bills. For commercial and industrial property owners, this transition also involves adjustments in how their properties are valued and taxed over time.

Staying informed about these changes and understanding how they affect your property tax bill is crucial. It ensures that you can plan effectively for any potential increases or decreases in your property tax obligations in Ottawa.

Navigating the City of Ottawa’s Capping Program

The City of Ottawa’s capping program plays a significant role in property tax calculations, especially for commercial, industrial, and multi-residential property owners. Understanding this program is crucial for navigating property taxes effectively.

The Goal of Capping: The capping program aims to move all property owners towards paying taxes based on their Current Value Assessment (CVA) tax level. The CVA represents the market value of a property at a specific valuation date.

Options and Adjustments: Since 2006, Ottawa has implemented various options to accelerate the transition to CVA taxes. These include limiting increases and implementing adjustments for properties that have reached or are close to their CVA tax level.

Capping Protection and Clawbacks: The capping program includes mechanisms like capping protection and clawbacks. Capping protection limits the increase in property taxes for eligible properties. Clawbacks, on the other hand, are adjustments made to offset reductions in other properties’ taxes within the same class.

Impact on Property Taxes: For property owners, understanding how the capping program affects their tax bill is crucial. Properties that have reached their CVA in the previous year or are transitioning between categories within the program may see different tax impacts. This could include being subject to claw back adjustments or exiting the capping program.

The City of Ottawa’s capping program is a complex aspect of the property tax system, but it’s integral for fairness and equity in tax distribution among different property classes. As a homeowner or property owner in Ottawa, familiarizing yourself with the capping program’s intricacies can help you better understand your property tax bill and prepare for potential changes in your tax obligations.

Additional Charges and Fees on Property Tax Bills

In addition to the standard property tax calculations, Ottawa residents may notice additional charges on their property tax bills. These charges are for services that are essential for maintaining the city’s infrastructure and quality of life.

Stormwater Charge: One of the additional charges is for stormwater management. This fee is applied to properties that do not receive a water utility bill. The charge supports the city’s efforts in managing stormwater, ensuring it is safely transported throughout Ottawa to protect roads, properties, and waterways from flooding and erosion.

Residential Garbage Collection Fee: Another significant charge on the property tax bill is for residential garbage collection. This fee is based on a full cost recovery model and varies annually. For 2023, the rate is set at $130 per residential household per year for curbside collection services, and $83.50 per unit per year for multi-residential buildings. The fee reflects the costs associated with new solid waste collection contracts, market conditions, and additional operational pressures.

These additional charges are critical for the city’s environmental management and waste disposal services. Understanding these fees and their impact on the overall property tax bill helps residents in Ottawa appreciate the value of the services they receive and plan their finances accordingly.

Dealing with Penalties and Interest for Late Payments

An important aspect of managing property taxes in Ottawa is understanding the implications of late payments. Like many municipalities, Ottawa imposes penalties and interest on overdue property tax payments to encourage timely settlement.

Penalty and Interest Rate: In Ottawa, a penalty and interest rate of 1.25% per month is applied to late property tax payments. This charge is added the day after the payment due date and on the first day of each subsequent month until the outstanding amount is paid in full.

Impact of Late Payments: This additional charge can add up quickly, increasing the financial burden on homeowners who delay their property tax payments. It’s crucial for property owners to be aware of their tax bill due dates and plan accordingly to avoid these extra costs.

Avoiding Late Payment Charges: Property owners are encouraged to explore various payment options offered by the city, such as pre-authorized payment plans, to ensure timely tax payments and avoid penalties. Staying organized and informed about payment deadlines is key to managing property tax obligations effectively and avoiding unnecessary expenses.

Understanding the implications of late payments and taking proactive steps to avoid penalties and interest is an essential part of responsible property ownership in Ottawa. By keeping informed and planning ahead, homeowners can ensure they meet their property tax obligations on time and maintain good financial standing with the city.

Navigating property taxes in Ottawa requires a clear understanding of how they are calculated, including the factors that affect your tax bill and the additional charges that may apply. From the basics of tax calculation to the nuances of the capping program and the importance of timely payments, homeowners in Ottawa need to stay informed and proactive in managing their property tax obligations. Keeping abreast of the changes in assessment procedures, understanding the additional fees for essential services, and being aware of the penalties for late payments are all crucial for effective financial planning. As a homeowner in Ottawa, equipping yourself with this knowledge not only ensures compliance but also helps in making informed decisions about your property and financial health. Remember, a well-informed homeowner is an empowered homeowner, capable of navigating the complexities of property taxes with confidence and ease.