In the intricate world of real estate investment, non-resident landlords in Canada face a unique set of challenges, particularly when it comes to navigating the complex tax laws. Understanding these regulations is crucial for anyone owning property in Canada but residing elsewhere. This article aims to demystify the often-complex tax obligations imposed by the Canadian Revenue Agency (CRA) on non-resident landlords. From rental income to various tax forms, we’ll provide a comprehensive guide to help you stay compliant and avoid potential penalties. With a focus on key aspects such as tax obligations, crucial documentation, and compliance requirements, this guide is an essential resource for non-resident landlords looking to manage their Canadian property investments effectively.

Understanding Non-Resident Tax Obligations

Navigating Canadian Tax Laws: A Primer for Non-Resident Landlords

For non-resident landlords, understanding the Canadian tax system is paramount. The Canadian tax landscape is intricate, particularly when dealing with rental income from real or immovable property. As a non-resident, you are subject to specific tax obligations, distinct from those of Canadian residents.

Defining Non-Resident Status in Canada

Non-residency, for tax purposes, is defined by your physical presence, residential ties, and duration of stay in Canada. If you live outside Canada, but own rental property within its borders, you fall under this category. It’s crucial to determine your residency status, as it directly influences your tax liabilities.

Rental Income Taxation: The Basics

Rental income from Canadian property is subject to taxation. As a non-resident, you must report this income to the CRA. The tax rate on rental income for non-residents is set at a flat 25%. However, this rate can vary depending on treaties between Canada and your country of residence.

Form NR6: Undertaking and Compliance

One key element in managing your tax obligations is Form NR6 – an undertaking to file a Canadian income tax return. By submitting this form, you agree to file an annual tax return for your rental income. It allows the calculation of your tax based on net rental income, potentially reducing the amount of taxes withheld.

Section 216 Election: A Tax Strategy

Electing under Section 216 is a strategic move for non-residents. This election allows you to pay tax on your net Canadian rental income rather than the gross amount. Filing Form T1159 is part of this process. While it requires more paperwork, the potential tax savings make it a consideration worth exploring.

Navigating Double Taxation Agreements

Canada has tax treaties with many countries to avoid double taxation. These agreements may allow you to claim a foreign tax credit in your country of residence for the taxes paid in Canada. Understanding these treaties can be pivotal in effective tax planning.

Key Tax Forms and Documents

Essential Paperwork for Non-Resident Landlords in Canada

As a non-resident landlord in Canada, staying on top of your tax obligations involves familiarizing yourself with several key forms and documents. These forms are crucial for ensuring compliance with Canadian tax laws.

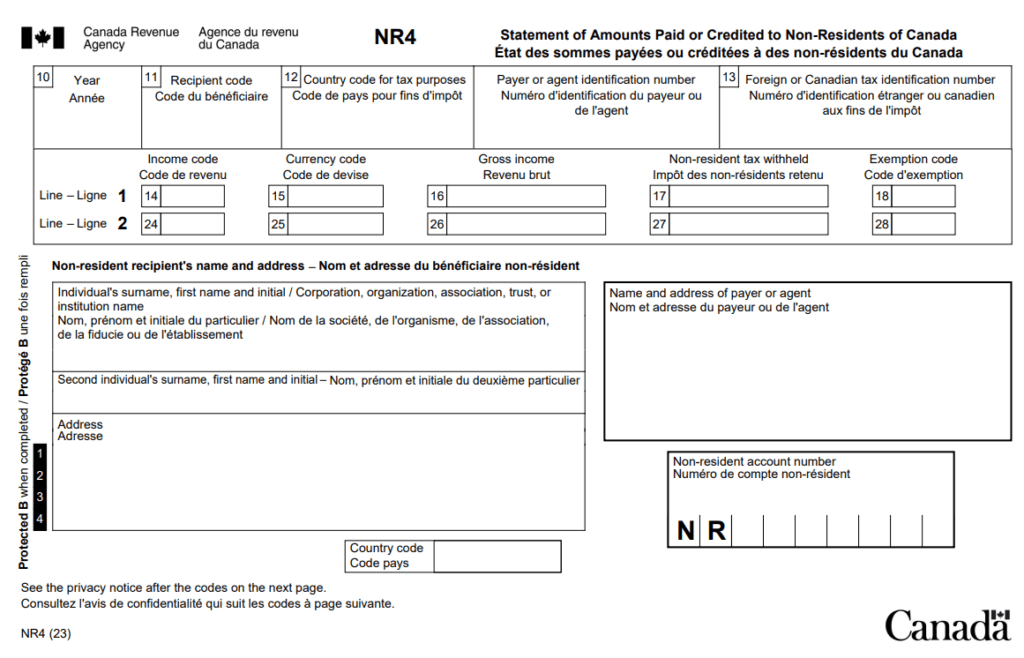

NR4 – Non-Resident Tax Withholding, Remitting, and Reporting

The NR4 form is a fundamental document for non-resident landlords. It outlines the tax withholding, remitting, and reporting requirements related to income like rents received from Canadian properties.

T4061 – A Guide for Canadian Payers

The T4061 guide is an invaluable resource for Canadian payers and withholding agents. It offers detailed instructions on filling out the NR4 slip and summary, along with important updates such as the enhanced Web Access Code digital service.

T4144 – Income Tax Guide for Electing Under Section 216

For those who choose to elect under Section 216, the T4144 guide is essential. This guide provides comprehensive information on how to file an income tax return for your rental income under this section.

NR6 – Undertaking to File an Income Tax Return

Form NR6 is an undertaking by non-residents to file a Canadian income tax return. Submitting this form allows the calculation of tax based on net rental income, which could lead to a reduction in the amount of taxes withheld.

Navigating Compliance and Reporting Requirements

Understanding how to properly fill out, submit, and use these forms is key to maintaining compliance with the CRA’s requirements. Non-resident landlords must be diligent in ensuring that all paperwork is accurate and submitted timely to avoid penalties.

Compliance and Penalties

Understanding the Consequences of Non-Compliance in Canadian Tax Law

For non-resident landlords in Canada, understanding and adhering to compliance requirements is critical to avoid penalties. The Canadian tax system imposes strict regulations and penalties for non-compliance, emphasizing the importance of accurate and timely tax-related procedures.

Mandatory Electronic Filing and Penalties for Late Filing

The threshold for mandatory electronic filing of information returns has been lowered, making it essential for landlords to comply with electronic submission requirements. Failure to file information returns over the Internet can result in penalties, especially if more than five returns are involved.

Penalties for Failure to Deduct or Remit Taxes

Landlords who fail to deduct or remit the required Part XIII tax from payments to non-residents can face significant liabilities. This includes being liable for the unremitted tax amounts and additional penalties and interest charges for failure to deduct or remit these taxes.

Late Filing of NR4 Information Return

Failing to provide the NR4 slip to recipients and file the NR4 information return on time can attract penalties. The Canada Revenue Agency (CRA) has policies to ensure that these penalties are fair and reasonable, particularly for small businesses.

Importance of Accurate Information and Compliance

It’s essential to make a reasonable effort to obtain and provide correct information on information returns. Failure to comply with this requirement can lead to a penalty of $100 for each failure.

Avoiding Penalties through Diligence and Professional Advice

Given the complexities of the tax system, non-resident landlords are advised to seek professional tax advice and be diligent in their tax-related responsibilities to avoid these penalties and ensure full compliance with Canadian tax laws.

The Role of Knowledgeable Property Management in Ensuring Compliance

In conclusion, non-resident landlords in Canada face a complex array of tax laws and regulations. Understanding and adhering to these regulations is not just about compliance; it’s about smart property management. Knowledgeable property management can be the key to navigating these tax obligations effectively. It involves staying updated on changes in tax laws, understanding the importance of accurate and timely filing of various tax forms, and recognizing the consequences of non-compliance. Seeking professional advice and guidance is often a wise decision, ensuring that your investment remains profitable and compliant under Canadian tax laws.

Are you looking to discuss your property management needs? Be sure to get in touch with us or request a Free Property Management Quote.